Difference between revisions of "Product Search/Edit"

(→ Screen Shots / Steps) (Tag: Visual edit) |

(→Roles) (Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

== '''Roles''' == | == '''Roles''' == | ||

| − | + | Purchase Admin | |

== ''' Path''' == | == ''' Path''' == | ||

| − | + | Vendor » Product Search/Edit | |

== '''Terminology Used''' == | == '''Terminology Used''' == | ||

| Line 52: | Line 52: | ||

- Able to set depreciation percentage for each product item. | - Able to set depreciation percentage for each product item. | ||

| − | == == | + | == '''Step by Step''' == |

'''Product search/edit''' | '''Product search/edit''' | ||

Revision as of 18:47, 10 April 2020

Roles

Purchase Admin

Path

Vendor » Product Search/Edit

Terminology Used

Base Product – Highest type of Product hierarchy E.g. Computer and Peripherals, Furniture etc…

Depreciation - Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life or life expectancy. Depreciation represents how much of an asset's value has been used up. Depreciating assets helps companies earn revenue from an asset while expensing a portion of its cost each year the asset is in use

Purchase Unit – the "Purchasing UoM" refers to the units that the vendor uses in the invoice. "Items per Purchase Unit" refers to how many items are in each Purchasing UoM

Stocking Unit – The stocking UOM describes how you store quantities of an item in the warehouse. You can use the stocking UOM for a variety of transactions, including transfers, container management, adjustments, picking, and ordering.

Conversion Factor – A conversion factor is the number or formula you need to convert a measurement in one set of units to the same measurement in another set of units.

HSN Code - HSN means Harmonized System of Nomenclature code used for classifying the goods under the GST, Goods and Service Tax.

SAC Code - The SAC code means Services Accounting Code under which services fall under GST are classified.

Input Needed

Base Product

Product Category

Product Name

Purchase UOM

Stocking UOM

Conversion Factor

Depreciation Method

Depreciation Percentage

Life of Product

Functionality

- User can add new product

- User can add product category under Base product E.g. Base product will be Furniture and Product category can be wooden Chair, Revolving chair, Table etc…

- User can define the product hierarchy under Base product E.g. Product under Product category and product category will be under of Base product.

- User can edit the product details like Product name, Ledger for Depreciation and percentage, life of product etc…

- User can search product item from the list.

- Able to set depreciation percentage for each product item.

Step by Step

Product search/edit

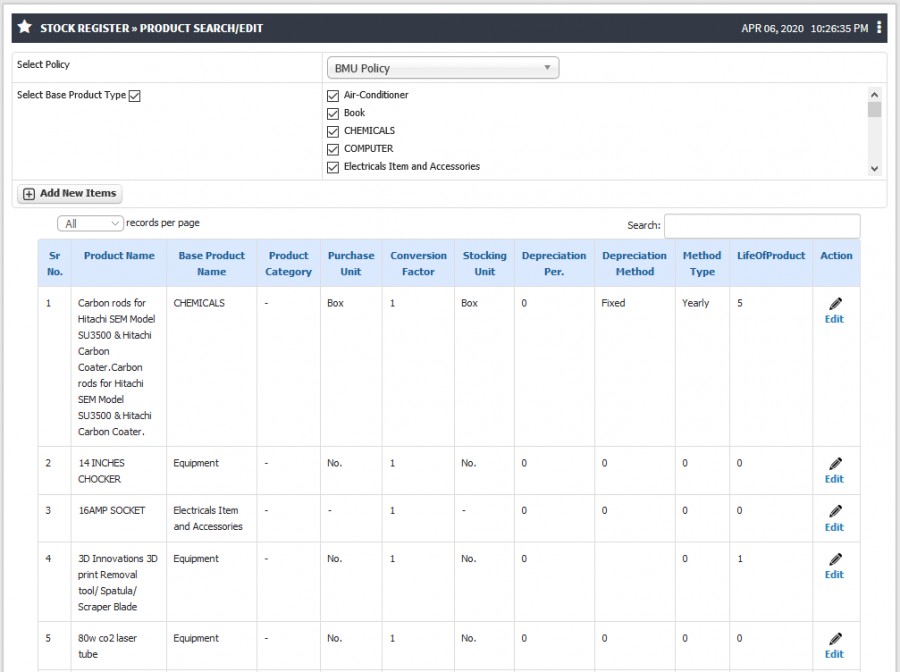

- Admin will get the list of product and base product.

- Admin can select the base product from the list to filter the product list.

- To search particular product from the list type the product name in searchable text box.

Add New Product

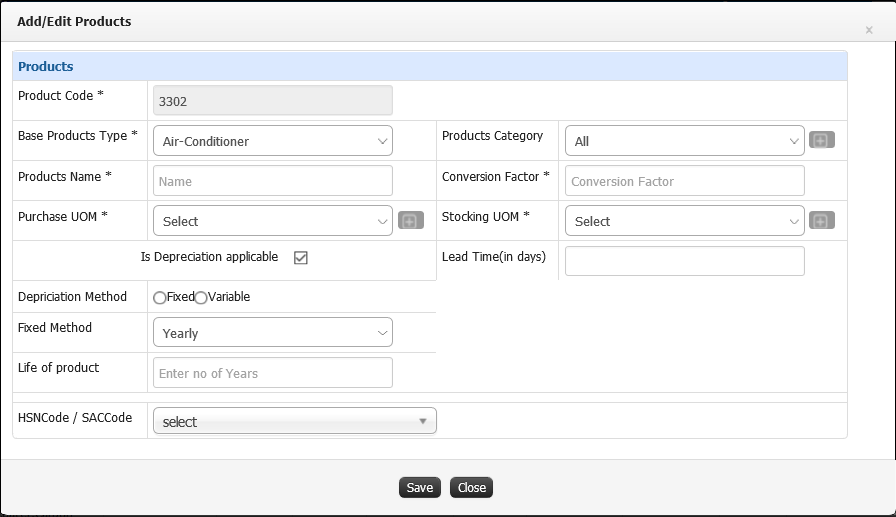

- Admin have the provision to add new product in the system.

- To add new product click on Add New Items button.

- Select base product, product category from the drop down and Enter all the details, After filling all the details click on Save button.

- Admin have the access to apply depreciation on that product.

- Once admin decided to apply depreciation on that product click on Is depreciation applicable checkbox further details will be asked by the system.

- Select the depreciation method ( Fixed / Variable ) and other details click on Save.

Edit Product Details

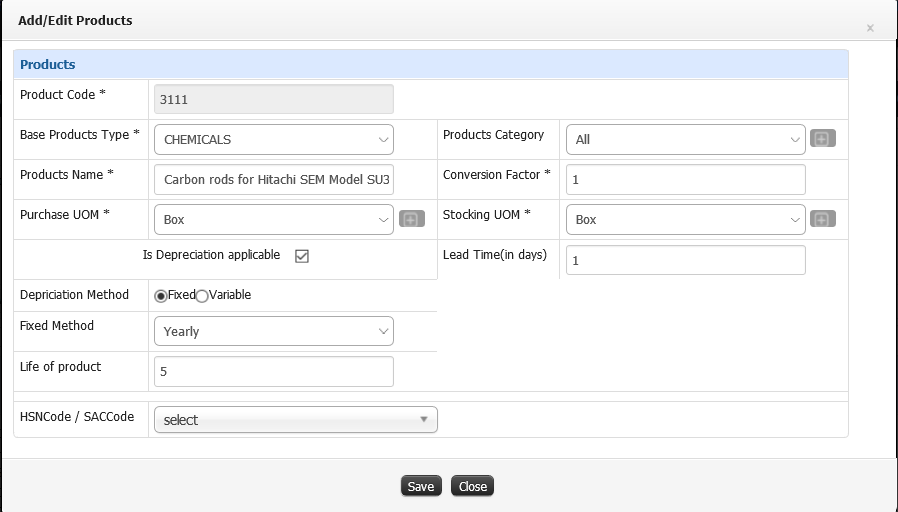

- Admin have the provision to edit the product or depreciation details at any point of time.

- To edit the details search the product from the list and click on Edit icon.

- Do the necessary modification and click on save button.