CTC

Contents

Cost To Company (CTC) Report

Cost to company (CTC) is a term for the total salary package of an employee. It indicates the total amount of expenses an employer (organization) spends on an employee during one year. It is calculated by adding salary to the cost of all additional benefits an employee receives during the service period. If an employee's salary is ₹50,000 and the company pays an additional ₹5,000 for their health insurance, the CTC is ₹55,000. Employees may not directly receive the CTC amount.

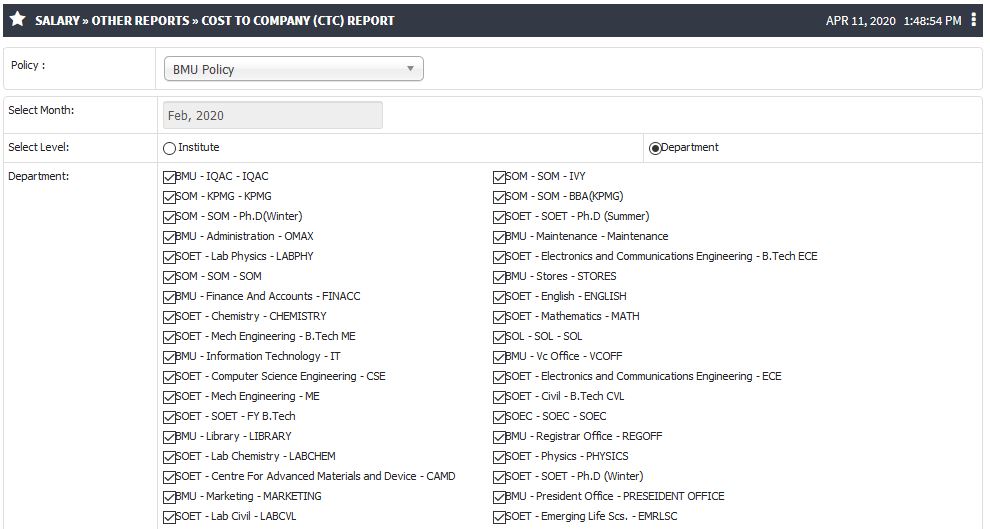

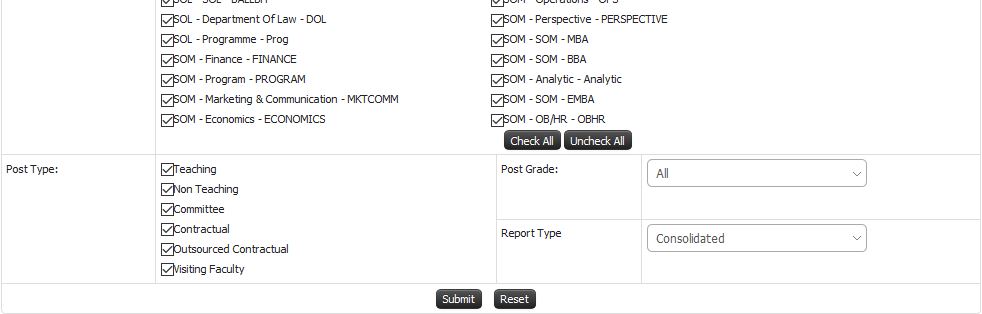

In our software system, this report can be viewed specific to a particular department or a consolidated report for all departments in the organization. In this particular section we will see how this report can be viewed and downloaded and how it helps the management.

Role

Finance Admin

Path

Salary » Other Reports » Cost To Company (CTC) Report.

Inputs Needed

- Salary for the particular month for which the CTC reports needs to be viewed should be published.

Functionality

- As discussed earlier CTC comprises of Employee wise net paid salary along with the benefits.

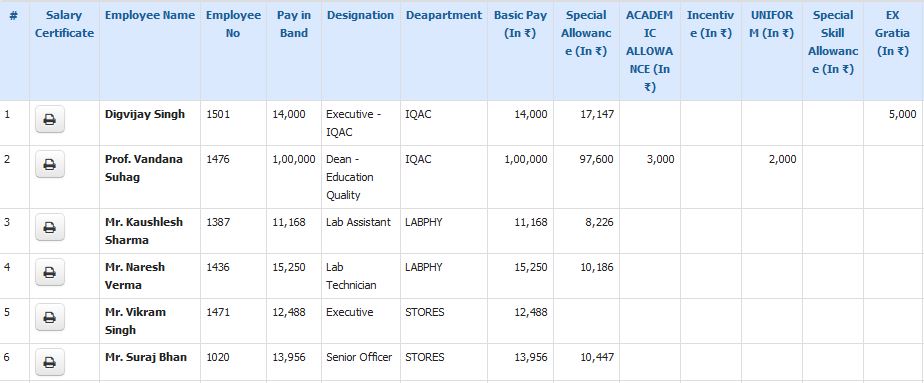

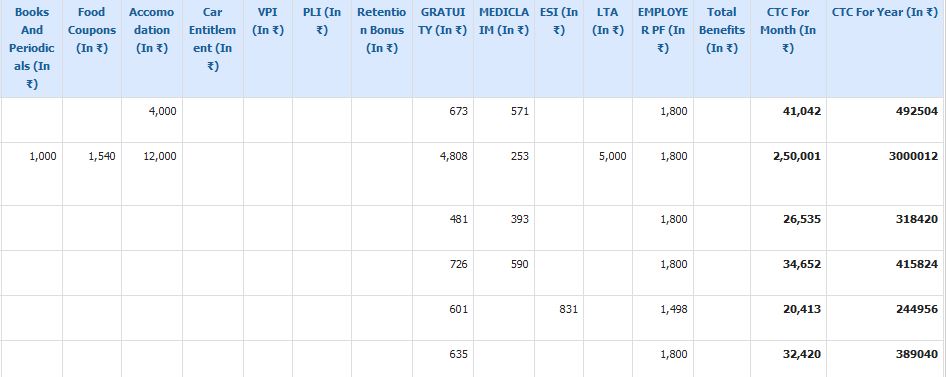

- The Finance Admin can view the salary component wise amount paid to each employee.

- The report can be viewed for a specific month or annually.

- The system provides the functionality to generate employee wise report in editable as well as non editable format i.e. excel and pdf format.

- The final CTC amount is calculated based on the Gross Salary of the employee along with the other benefits such as EPF, ESIC, Insurance, etc.

- Salary certificate for individual employee can be downloaded.

Step by Step

CTC ReportCTC Report Continued

- Initial Configuration

- Terminology Used in Initial Configuration

- Basic Structure Creation

- Mappings

- Liaisons

- Master Lists

- Legacy Data Upload

- Initial Data Template

- Employee Data Template

- Student Data Template

- Course Data Template

- Infrastructure Data Template

- Finance Data Template

- Stock/Inventory Data Template

- Library Data Template

- Attendance Data Template

- Grade/Marks Data Template

- Quiz Questions Data Template

- Employee Profile Data Template

- Initial Configuration FAQ

- Admission

- Terminology Used in Admission

- Admission Configuration

- Guideline Configuration

- Departments and Program association

- Entrance exam Configuration

- Admission Quota and Category Configuration

- Admission Document Configuration

- Admission intake configuration

- Admission Eligibility Configuration

- Admission Rounds Configuration

- Merit List Configuration

- Direct Admission

- Admission Process

- Admission Test

- Lead Management

- Admission FAQ

- Academics

- Terminology Used

- Program Creation

- Syllabus Pattern Creation

- Syllabus Structure

- Course Outline

- Faculty Course Management

- Student Course Management

- Time Table

- Course File

- Attendance

- Concurrent Assessment

- Outcome Based Evaluation

- Learning Management System(LMS)

- Topic Registration

- Synopsis

- Defining Research Project

- Creating Evaluation Parameter

- Project Guide Configuration

- Synopsis Configuration

- Submission of Synopsis by Student

- Synopsis Approval by Guide

- Synopsis Approval by HOD

- Synopsis Approval by Thesis Department

- Synopsis Approval by Dean Login

- Email Alerts to referee

- Synopsis Approval by Referee Login

- Colloquium

- Thesis

- Defining Research Project

- Creating Evaluation Parameter

- Project Guide Configuration

- Thesis Configuration

- Submission of Thesis by Student

- Thesis Approval by Guide

- Thesis Approval by HOD

- Thesis Approval by Thesis Department

- Thesis Approval by Dean Login

- Thesis Approval by Referee Login

- Referee Report

- Request for Open Defense

- Open Defense Request Approval by HOD

- Open Defense Request Approval by Chair Person

- View Referee & Guide Report

- Final Thesis

- SIP

- On-Line Test Through Course File

- Feedback

- Student Leave

- Mentor Student Module

- Academics FAQ

- Exam

- Terminology Used in Exam

- Exam Admin Role

- Creating University

- Defining Stream

- Defining Qualification

- Open Electives

- Syllabus and Pattern Creation

- Syllabus and Subject

- Term Exam Structure

- Exam Duty Configuration

- SMS and e-Mail Pattern Configuration

- Result Reference Key Configuration

- Exam Center Code Configuration

- Exam Schedule Configuration

- Exam Configuration

- Paper Valuer

- Answer Sheet Correction Allocation

- Exam Form Notification

- Student Exam Form

- Hall Ticket Generation

- Exam Paper Finalization

- Exam Invigilator

- Exam Hall Attendance

- Grace Policies

- Internal - External Marks Entry

- Spot Evaluation Marks Entry

- Internal Exam Marks

- Vocational Subject Marks

- Forward Marks for Result Processing

- Grace Calculation

- Process Result

- Marks Moderation

- Result Processing and Totaling

- Student Exam Dashboard

- Legacy Marks Entry

- Internal Exam Configuration

- Internal Subject Allocation

- Internal Subject Marks

- Faculty Role

- Student Role

- Exam FAQ

- Finance

- Terminology Used in Finance

- Budget

- Defining Budget Title

- Defining Groups and Subgroups and Ledgers

- Associating Employees with Ledgers for Budgetary Estimates

- Budget Estimates by Employees

- Scrutiny and Revision of Budget by Finance Admin

- Finalizing and Freezing Budget Amounts

- Notification to Employees on Budgeted amounts

- Budgetary Alerts

- Budget Variance

- Fees

- Terminology Used in Fees

- Academic Fees Structure

- Fee Components

- Fee Amount corresponding to Quota and Category

- Sponsorship Bodies

- Fees Installments

- Part Payments

- Fee Advances

- Fee Refund

- Late Fees

- Admission Cancellation

- Invoices and Receipt

- Scholarship

- Sponsorship

- Hostel Fees

- Transport Fees

- Exam Fees

- Library Fees

- Miscellaneous Fees

- Fines

- Fees FAQ

- Salary

- Salary Configuration

- Employee Salary Parameter Mapping

- Employee Salary Adjustments

- TDS Configuration

- TDS Calculation

- Salary Calculations

- Leave Availing Rules

- Arrears Configuration

- Arrears Calculation

- Employee Account Details

- Employee Salary Payable

- Employee Salary Transfer

- Visiting Faculty Payable

- PF

- ESIC

- Insurance

- Gratuity

- Leave Encashment

- LTA

- Medical Reimbursement

- Monthly Reports

- Yearly Reports

- CTC

- FnF

- Purchase/Vendor Accounting

- Sales/Client Accounting

- General Accounts

- Investment Management

- Endowment Management

- Employee Society

- Finance FAQ

- HR

- Terminology Used in HR

- Recruitment

- Terminology used in recruitment

- Recruitment Liaison

- University Post Configuration

- Recruitment Process

- Recruitment Liaison Disclaimer

- Recruitment Liasoning Finance Association

- Office Document Configuration

- Recruitment Test Configuration

- Applicant Employee registration

- Log Report

- Registered Applicant Employee

- Applicant Employee Profile Report

- Applicant Employee Referenced Detail

- Applicant Employee Documents

- Call for GD/PI

- GD or PI Marks

- Call For Interview

- Offer Letter

- Joining Report

- Service Book

- Service Book

- Muster

- Muster Policy Creation

- Employee Worktime

- Working Hours

- Biometric Devices

- Fingerprints

- Daily Attendance Report

- Monthly Muster Report

- Muster Freezing

- Input for Salary Calculation

- Leave Deductions

- Late coming and Early going

- Consolidated Attendance Report

- Muster Incomplete Task

- Missed Punch Request

- Request for waive off short day

- Leave

- Salary

- Salary Configuration

- Employee Salary Parameter Mapping

- Employee Salary Adjustments

- TDS Configuration

- TDS Calculation

- Salary Calculations

- Leave Availing Rules

- Arrears Configuration

- Arrears Calculation

- Employee Account Details

- Employee Salary Payable

- Employee Salary Transfer

- Visiting Faculty Payable

- PF

- ESIC

- Insurance

- Gratuity

- Leave Encashment

- LTA

- Medical Reimbursement

- Monthly Reports

- Yearly Reports

- CTC

- FnF

- Employee Profile

- Personal Details

- Family Details

- Medical Details

- Qualification

- Subject Taught

- Training

- Conference/Seminar/Conclave

- Workshop

- Publications

- Consultancy

- Research Project

- Research Guidance

- Membership

- Patents/Copyrights

- Skill Upgradations

- Research Interest

- Significant Achievement

- Other Contributions

- Appointment Status

- Service Book

- Self Contribution/Addl.Responsibilities

- Foreign Collaboration

- Brief Profile

- Appraisal

- Grievance

- Contractual Appointment

- Resignation

- No Dues

- Full and Final Settlement

- HR FAQ

- Procurement and Stores

- Terminology Used in Procurement and Stores

- Infrastructure

- Maintenance

- Stock

- Product Search/Edit

- Dead Stock Configuration

- Dead Stock Register

- Stock Allocation

- Infrastructure Incharge Allocation

- Employee Seating Arrangement

- Vendors

- Vendor Feedback

- Marketing Company

- Gate Pass

- Good Receipt Note (GRN)

- Generate Work Order

- Internal Maintenance Report

- External Maintenance Report

- Stock Reports

- Employee Login(Stock)

- Stock FAQ

- Inventory

- Purchase

- Abbreviations

- Add Vendor

- Vendor Registration Configuration

- Vendor Approval

- Vendor Feedback

- Add Base Product

- Product Search/Edit

- Purchase Requisition Authority

- Purchase Authority

- Signature Authority

- Purchase Requisitions

- Generate Requisition

- Generate Purchase Order Without RFQ

- Request for Quotations

- Add Quotation

- Quotation Opening

- Quotation Analysis

- Quotation Configuration

- Approved Rate Contracts

- Tender Configuration

- Tender

- List of Purchase Orders

- Purchase Order Clauses

- Add Delivery Challan

- Add Invoice

- Purchase Payment Request

- Reports

- Vendor Login

- Employee Login

- Student Login

- Finance Login

- Purchase FAQ

- Research

- Terminology Used in Research

- Employee Research Contribution

- Funded Research Project

- Research Courses

- Admission

- Assessment

- Synopsis

- Defining Research Project

- Creating Evaluation Parameter

- Project Guide Configuration

- Synopsis Configuration

- Submission of Synopsis by Student

- Synopsis Approval by Guide

- Synopsis Approval by HOD

- Synopsis Approval by Thesis Department

- Synopsis Approval by Dean Login

- Email Alerts to referee

- Synopsis Approval by Referee Login

- Thesis

- Defining Research Project

- Creating Evaluation Parameter

- Project Guide Configuration

- Thesis Configuration

- Submission of Thesis by Student

- Thesis Approval by Guide

- Thesis Approval by HOD

- Thesis Approval by Thesis Department

- Thesis Approval by Dean Login

- Thesis Approval by Referee Login

- Referee Report

- Request for Open Defense

- Open Defense Request Approval by HOD

- Open Defense Request Approval by Chair Person

- View Referee & Guide Report

- Research FAQ

- Internal Communication

- Committees

- Terminology Used in Committees

- Add Committee Details

- Update Details

- Committee Member

- Committee Responsibility

- Committee Meeting

- Agenda Creation

- Approve Agenda

- Send for Notification

- MOM Tracking

- MOM Approval

- MOM Sharing

- Announcement

- Event

- Meeting Attendance

- Committee Institute Mapping

- Committee Document Verification

- Budget

- HR request Generation

- Alert to Principal/HR/Director

- HR Approval

- Committee Approval

- Committee Agenda

- Committees FAQ

- Terminology Used in Committees

- Hostel

- Terminology Used in Hostel

- Hostel Configuration

- Hostel Admission

- Hostel Allocation

- Registration Approval

- Generation of Merit List

- Student Parent Contact Details

- Generation of I-Card

- Mess Allocation

- Stock Allotment

- Room Transfer/ Cancellation

- Occupant Search

- Occupant Attendance

- Leave/Night-out Request

- Fine Imposition

- Group Fine

- Guest House

- Guest Room Request Approval Configuration

- Guest Room Booking

- Guest Room Approval

- Hostel Complaint and Maintenance

- Hostel and Related Reports

- Hostel FAQ