Difference between revisions of "Salary"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

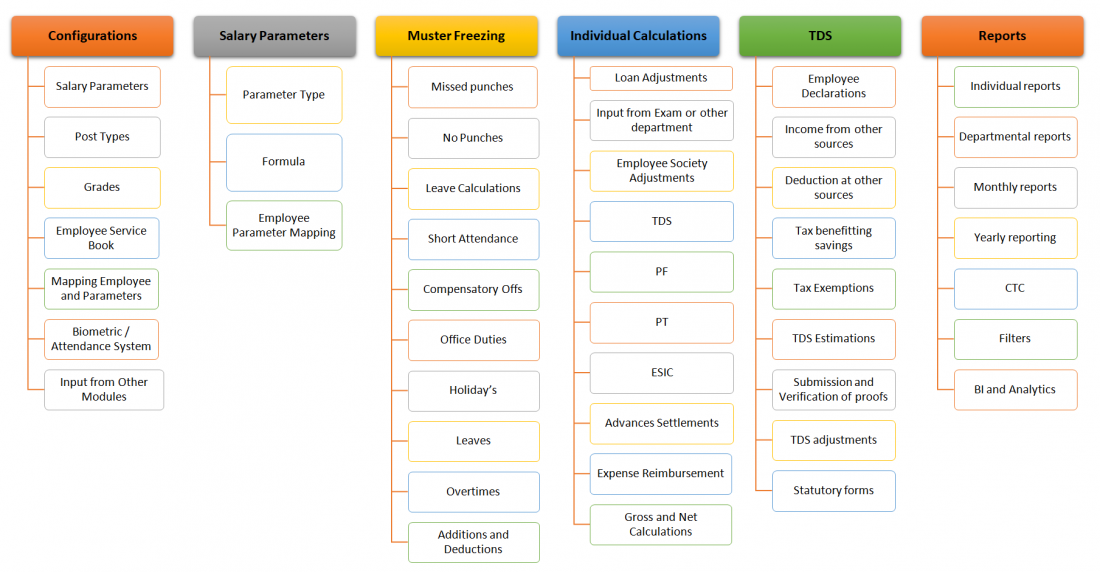

| + | [[File:Salary Overview.png|alt=Salary Overview|none|thumb|1100x1100px|Salary Overview]] | ||

| + | |||

== '''Salary Dependence on Service Book''' == | == '''Salary Dependence on Service Book''' == | ||

# Service book entry is a must for Salary calculation. | # Service book entry is a must for Salary calculation. | ||

| Line 171: | Line 173: | ||

After Publishing, selected employees pay-slip can be downloaded as a PDF from Finance Admin login, and individual employee login | After Publishing, selected employees pay-slip can be downloaded as a PDF from Finance Admin login, and individual employee login | ||

| − | == ''' | + | == '''TDS, Savings and Deductons''' == |

| + | * Employee get to fill a form to declare his intended saving schemes. | ||

| + | * Based on that approximate calculations of monthly TDS on a pro-rate bases is done for each employee, by the finance admin. | ||

| + | * Later on employee are supposed to upload attachments of saving scheme receipts. | ||

| + | * In the last couple of months of financial year, exact calculations are done and TDS deductions are adjusted against salary payments. | ||

| + | |||

| + | == '''Bank Transfer Letter''' == | ||

| + | |||

| + | According to the employee details configuration, bankwise Transfer letters can be extracted in PDF Format. | ||

| + | |||

| + | Facility is given to download excel, which can be sent to the banks for facilitating salary transfer. | ||

| + | |||

| + | == '''Arrears Payment''' == | ||

| + | * Arrears can be paid along with salary, and hence will be included in Bank Transfer letter. | ||

| + | * Separate Bank Transfer Letter can be generated only to pay arrears. | ||

| + | * If Arrears are not paid with salary, but against payment vouchers, cheques can be generated for the same. | ||

| + | |||

| + | == '''Other Benefit Payments''' == | ||

| + | |||

| + | '''<u>Leave Encashment</u>''' | ||

| + | |||

| + | * Complete flow for Leave encashment is given in the Leave module. Once the request is accepted, the finance admin finalizes the amount though formula based calculation and pays through payment voucher against which cheque is generated. | ||

| + | * Request status becomes closed and paid. | ||

| + | * Related reports can be extracted – No of encashment request by an employee, current remaining leave balance along with corresponding amount, Total amount paid until now. | ||

| + | |||

| + | '''<u>Any type of other benefits can be formulated and calculated.</u>''' | ||

| + | * LTA | ||

| + | * Medical Reimbursement | ||

| + | * Gratuity Payment | ||

| + | Payment of other benefits can be made through payment vouchers | ||

| + | |||

| + | == '''Payment/Recovery Request''' == | ||

| + | * Overtime, other duty remuneration like paper setting, invigilation etc. needs to be paid along with the salary. Each department can calculate such payables / recoverable and after freezing can forward the payment/recovery to the finance department. | ||

| + | * The finance admin can decide to include these as a part of salary. He has to select the component against which payment/ recovery needs to be paid and in which month salary. | ||

| + | * Accordingly salary calculations get adjusted. | ||

| + | Payment disbursement can be done through | ||

| + | * Bank transfer – in which case transfer letters are generated | ||

| + | * Against payment vouchers in cash or through cheque or draft | ||

| + | |||

| + | == '''Ledger Finalization''' == | ||

| − | + | Salary Payable (Liable) and Salary ledgers (Expenses) are created for each employee. Statutory deposits ledgers also need to be configured. | |

Latest revision as of 10:47, 21 October 2019

Contents

- 1 Salary Dependence on Service Book

- 2 Salary Dependence on Muster Freezing

- 3 Salary Configuration

- 4 Salary Parameter Prioritization

- 5 Tax Slab Configuration

- 6 Employee A/c and other details mapping

- 7 Employee to salary parameter mapping

- 8 Arrears Configuration

- 9 Pay-slip Finalization

- 10 Error Rectification

- 11 Pay Slip Printing

- 12 TDS, Savings and Deductons

- 13 Bank Transfer Letter

- 14 Arrears Payment

- 15 Other Benefit Payments

- 16 Payment/Recovery Request

- 17 Ledger Finalization

Salary Dependence on Service Book

- Service book entry is a must for Salary calculation.

- Either of BASIC-PAY or consolidated forms the base for salary calculation.

- BASIC_PAY is defined in terms of Pay-in-Pay Band and Grade pay/Academic Grade Pay

- After Appraisal cycle change is reflected in the service book of the employee in form of incremented Pay-in-Pay Band and Grade pay/Academic grade pay.

- Grade pay/Academic grade pay also changes

- In case of promotion

- In case of demotion

- In case of Sabbatical

Salary Dependence on Muster Freezing

WORKING DAYS CALCULATION

CASE - 1

Working days calculation can be dependent on

- MUSTER (integrated with bio-metric and pulls attendance from there)

- LEAVE Register – Leave availed by employees and LWP’s

In such cases all calculations are automatic. Before calculation of salary Leave admin freezes attendance, and removes any discrepancies in the records, if any are present. After freezing of attendance Finance Admin calculates the salary.

CASE - 2

However in some organizations MUSTER ENTRIES are not COMPULSORY. In such cases configuration can be made such that each day default attendance of each employee is market unless he/she has applied for Leaves.

Provision however must be given to the Finance Admin to enter LWP manually at the time of Salary calculations. This is because Default attendance is market for each day even if the employee is absent and no leave application is filled.

FREEZING MUSTER

CASE - 1

Working days calculation can be dependent on

- MUSTER (integrated with bio-metric and pulls attendance from there)

- LEAVE Register – Leave availed by employees and LWP’s and LOP’s

In such cases all calculations are automatic. Before calculation of salary Leave admin freezes attendance, and removes any discrepancies in the records. After freezing of attendance Salary Admin calculates the salary.

Example :

- If no in-time and out time is and no leave application is found for a day for an employee.

- If only one punch is found for an employee on a day.

CASE - 2

However in some organizations MUSTER ENTRIES are not COMPULSORY. In such cases configuration can be made such that each day default attendance of each employee is market unless he/she has applied for Leaves.

Provision however is given to the Finance Admin to enter LWP manually at the time of Salary calculations. This is because Default attendance is market for each day even if the employee is absent and no leave application is filled.

Salary Configuration

The FIVE basic components (BASE COMPONENTS) DEFAULT

- PAY-IN-PAY Band (Entered while employee upload)

- Grade Pay (Entered while employee upload)

- Academic Grade Pay (Entered while employee upload)

- BASIC Pay (Although entered while employee upload, recalculated every month)

- Consolidated (If the employee is not on scale)

Addition Components – Any allowance added to the payment

Deduction Components – Any tax deducted from the payment

Each of the component needs to be defined in terms of whether

- It is core salary variable or an additional component

- It is formula based, slab based or manual (e.g. 80*BASIC, if Basic in range 0-4200 then 1600, or [null manual value] )

- Is it Part of a group (DA-60%, DA-72%, DA-83% all are grouped under common name DA)

- Should it be recalculated every month or carry forwarded (applicable only for manual variables) (DA vs Loan Amount)

- Should it be paid with the salary or by a separate payment voucher (Salary amount vs. Medical En-cashment)

Salary Parameter Prioritization

Define Priority in which all the salary components should be calculated

- Automatic Priority is given to the BASIC FIVE components

- Although BASIC PAY = PAY-IN-PAY Band + (GRADE PAY/ACADEMIC GRADE PAY)

Given in service book of the employee

- PAY-IN-PAY Band and GRADE PAY/ACADEMIC GRADE PAY is calculated again every month using formula

- Pay In Pay Band * ( Paid Leaves + Paid Holiday + Worked Days ) / Total Days

- AGP * ( Paid Leaves + Paid Holiday + Worked Days ) / Total Days

- And BASIC PAY id calculated again too.

Other than the BASIC FIVE components, all other parameters need to be given order in which they should be calculated. For example Gross Pay should be given last priority. After BASIC PAY calculation, DA can be calculated, any component which depends on DA can be calculated next.

Tax Slab Configuration

Various categories which determine TAX applicability are defined, e.g. different calculations are applied depending on GENDER (Male, female), SENIOR CITIZEN (Male, Female)etc.

Exemption Parameter – for example

- Section 80 C scheme(80CCC,80CCD): Upto limit 1.5 Lacs (PPF, LIC, Tax saving mutual funds)

- Section 80 TTA: Deduction from gross total income with respect to any Income by way of Interest on Savings account.

- Section 80D: Deduction in respect of Medical Insurance

- Section 80 EE: Deductions on Home Loan Interest for First Time Home Owners

Employee A/c and other details mapping

The following configuration is needed

- Bank Account details of the employee, where salary will be transferred

- A/c No

- Name

- Branch

- IFSC Code

- PAN A/c Number and Proof

- PF Account Number

- Gratuity Details – ID, eligibility date

- Date of Joining – for Eligibility date calculation for different benefits

- Date of Birth – For retirement purpose

Employee to salary parameter mapping

Each Employee needs to be configured with salary components

- Not all components are applicable to all.

- An employee living on Campus would not be given House rent Allowance but have to be recovered maintenance charges/electricity charges etc.

- Teaching Employee get Academic-Grade-Pay and Non-Teaching get Grade-Pay

- Multiple employees can be assigned to same set of parameters in one click

Arrears Configuration

Arrears can be configured in two ways.

CASE – 1 : On an individual component

It can be directly configured, from the screen where formula to calculate a specific component is defined. Arrear calculation cycle can be created. For e.g. 7 % increase on DA declared in July w.e.f. March, and then 2 % increase again on DA declared in august w.e.f. April.

Against every cycle payment disbursement cycle can be configured. E.g. Number of installments to be paid in specific months.The disbursement plan can be defined individually for each employee.

Calculation summary employee wise and month wise can be seen in the report. Report elaborates, according to attendance how much amount is calculated for each month and also disbursement summary.

e.g. One employee can get all the amount over September and October. While another can be given over FOUR months.

CASE – 2 : Back-dated increment

If salaries are already paid for Months July and August. And in the month of September increment is announced for employees w.e.f 1st July, then complete recalculation of salary needs to be done for July and August months. September month can be paid at one go using new BASIC-PAY value.

To achieve the above case while recording the increments for the employees we will need to define the Increment w.e.f date and increment order date separately.

A separate Arrears-pay-slip containing the difference in amount of all salary components, of what has already been paid and what was to be paid for each month can be generated.

A consolidated report listing all employees, differences of all months is generated by the system.

Decision can be taken to pay Arrears in the monthly salary, or through separate payment voucher.

Pay-slip Finalization

The Finance Admin can edit each employees pay-slip.

- If an employee was on LWP for 30 days then for that month he is not eligible for travelling allowance, although generally he get travelling allowance every month. Such one time adjustments can be done for any of the employees.

- Options are available for seeing specific parameter disbursed for the whole year for an employee

- Calculator is available for verifying calculations for manual parameters

- Auto-save options for saving edited changes is provided

- For specific months pay-structure changes can be carried out from here.

- Each amount calculation details in terms of formula and value can be checked from here.

- If an employee has been given increment in the middle of the month, then his salary needs to be calculated in two parts.

- Publishing of salary can be done from here

- In case of Arrears disbursement (Case – 1) a row shall be added for arrears. Possible actions are

- Edit Amount

- Postpone payment to another month

- Lock/Unlock operations on employee

- If employees are Adhoc or contractual and payment for particular months are not to be made for such employees they can be locked out from salary calculations.

- Publish/Un-Publish

- Salaries one finalized can be Published / Un-published.

- After Publishing employees can see there salary slips from there logins.

- Reflection in all reports will happen after Publishing Salary

Error Rectification

Error Types

Service book related

- Multiple Service Book entry

- Missing Service Book Entry

- Service Book entry WRONG/INCOMPLETE

- Date of Joining not specified in Service Book

Pay Structure related

- Pay structure not defined

Pay Slip Printing

After Publishing, selected employees pay-slip can be downloaded as a PDF from Finance Admin login, and individual employee login

TDS, Savings and Deductons

- Employee get to fill a form to declare his intended saving schemes.

- Based on that approximate calculations of monthly TDS on a pro-rate bases is done for each employee, by the finance admin.

- Later on employee are supposed to upload attachments of saving scheme receipts.

- In the last couple of months of financial year, exact calculations are done and TDS deductions are adjusted against salary payments.

Bank Transfer Letter

According to the employee details configuration, bankwise Transfer letters can be extracted in PDF Format.

Facility is given to download excel, which can be sent to the banks for facilitating salary transfer.

Arrears Payment

- Arrears can be paid along with salary, and hence will be included in Bank Transfer letter.

- Separate Bank Transfer Letter can be generated only to pay arrears.

- If Arrears are not paid with salary, but against payment vouchers, cheques can be generated for the same.

Other Benefit Payments

Leave Encashment

- Complete flow for Leave encashment is given in the Leave module. Once the request is accepted, the finance admin finalizes the amount though formula based calculation and pays through payment voucher against which cheque is generated.

- Request status becomes closed and paid.

- Related reports can be extracted – No of encashment request by an employee, current remaining leave balance along with corresponding amount, Total amount paid until now.

Any type of other benefits can be formulated and calculated.

- LTA

- Medical Reimbursement

- Gratuity Payment

Payment of other benefits can be made through payment vouchers

Payment/Recovery Request

- Overtime, other duty remuneration like paper setting, invigilation etc. needs to be paid along with the salary. Each department can calculate such payables / recoverable and after freezing can forward the payment/recovery to the finance department.

- The finance admin can decide to include these as a part of salary. He has to select the component against which payment/ recovery needs to be paid and in which month salary.

- Accordingly salary calculations get adjusted.

Payment disbursement can be done through

- Bank transfer – in which case transfer letters are generated

- Against payment vouchers in cash or through cheque or draft

Ledger Finalization

Salary Payable (Liable) and Salary ledgers (Expenses) are created for each employee. Statutory deposits ledgers also need to be configured.