Difference between revisions of "Salary Configuration"

(Tag: Visual edit) |

(→Step by Step) (Tag: Visual edit) |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 68: | Line 68: | ||

The color code is system defined and hence it becomes easier for the user to identify the component types. | The color code is system defined and hence it becomes easier for the user to identify the component types. | ||

| − | == ''' | + | == '''Step by Step'''== |

| + | # Salary Configuration Menu | ||

| + | [[File:Salary Configuration1.jpg|center|frameless|999x999px]] | ||

| + | 2. Add / Edit Component | ||

| + | [[File:Add Edit Component.jpg|center|frameless|801x801px]] | ||

| + | 3. Configuring Salary Component | ||

| + | [[File:Configure Component.jpg|center|frameless|981x981px]]4. Creating New Formula Configuration | ||

| + | [[File:New Formula.jpg|center|frameless|798x798px]]5. Configuring Salary Component | ||

| + | [[File:Configuring Component.jpg|center|frameless|1193x1193px]]6. Setting Salary Component Priority | ||

| + | [[File:Component Priority.jpg|center|frameless|991x991px]] | ||

| + | |||

| + | 7. Tax Slab | ||

| + | [[File:Tax Slab.jpg|center|frameless|993x993px]] | ||

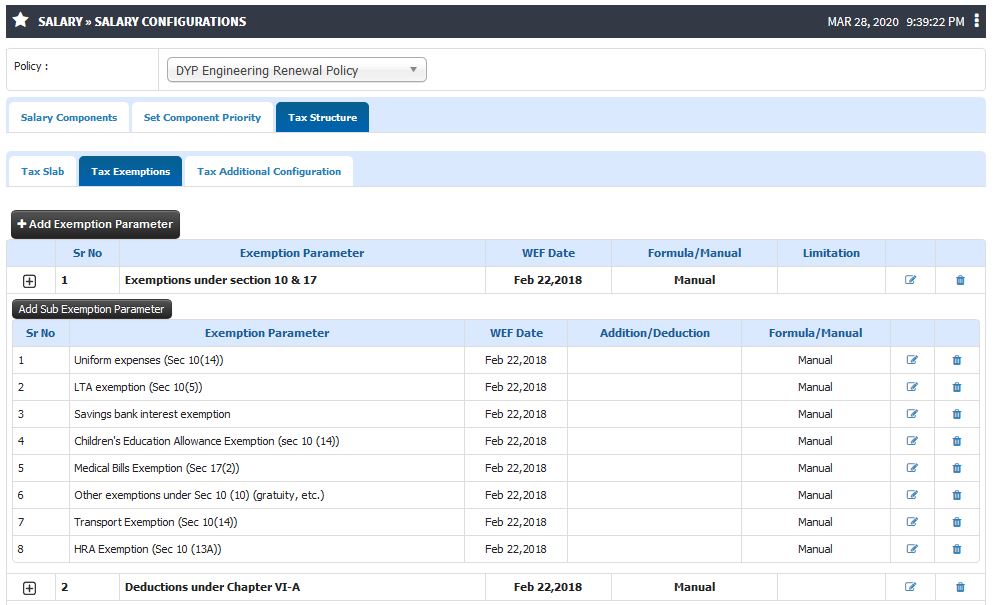

| + | 8. Tax Exemptions | ||

| + | [[File:Tax Exemption.jpg|center|frameless|996x996px]] | ||

| + | [[File:Tax Exemption2.jpg|center|frameless|994x994px]] | ||

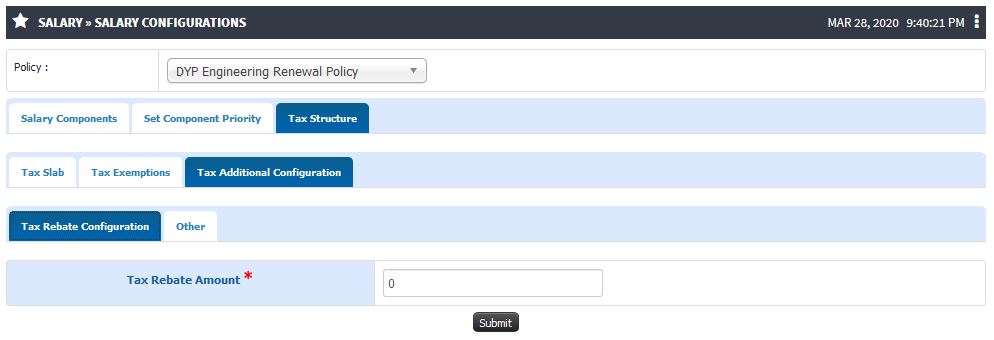

| + | 9. Tax Addition | ||

| + | [[File:Tax Addition.jpg|center|frameless|994x994px]] | ||

Latest revision as of 07:46, 28 March 2020

Prerequisite

- Institute Level Finance Policy should be configured.

- Renewal Detail for the Policy should be configured

Roles

Finance Admin

Path

Salary » Salary Configurations

Purpose

Salary Components

1. Configuring components on which salary calculation is based.

2. Salary components are defined by five basic components:

- Pay-In-Pay Band

- Grade Pay

- Academic Grade Pay

- Basic Pay

- Consolidated

3. We can Add/Edit components for following types:

- Addition

- Deduction

4. Components can be defined either formula based or manual entry.

5. Set formulas of each component (except manual) for respective post types at once.

6. Each component needs to be defined in terms of whether:

- It is core salary variable or an additional component.

- It is formula based, slab based or manual (e.g. 80*BASIC, if Basic in range 0-4200 then 1600, or manual value)

- Is it Part of a group (DA-60%, DA-72%, DA-83% all are grouped under common name DA)

- Should it be recalculated every month or carry forwarded (applicable only for manual variables) (DA vs. Loan Amount)

- Should it be paid with the salary or by a separate payment voucher (Salary amount vs. Medical Encashment)

7. Arrear components are added automatically when parent is added.

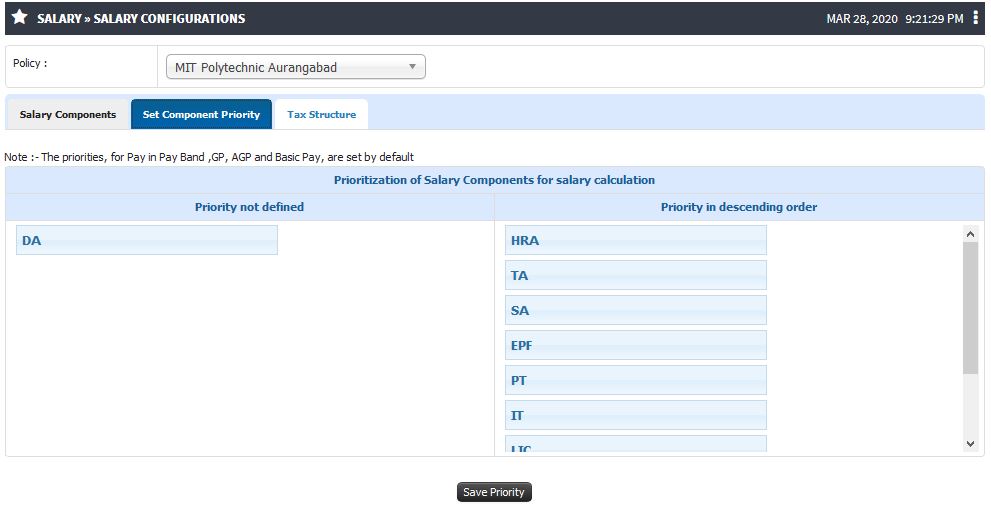

Set Component Priority

- For each component, its priority need to be set.

- The order of the execution of the components will depend on another property for each component. Thus “Component Priority” can be defined as whenever amount is calculated using respective formula, dependent component amount should be available. (Eg: If we have a TDS parameter for which the formula has been set as 10% of Basic Pay + Flat Allowance + DA, then priority for TDS parameter should be set after these three parameters as it is dependent on the values entered for these components.)

- Priority is set by default for Pay-In-Pay Band, Grade Pay , Academic Grade Pay, Basic Pay and Consolidated components.

- After any addition of the component or after editing the existing component, its priority needs to be set.

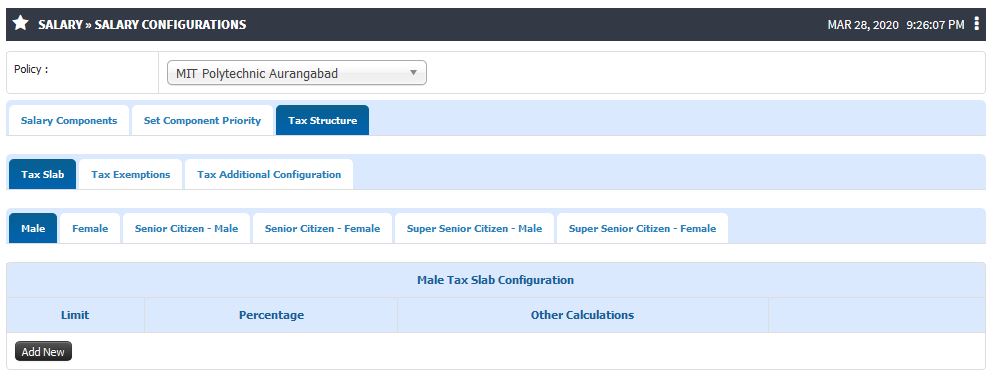

Tax Structure

1. Tax Slab

a. Tax slabs can be configured for following conditions:

- Male (Below 60 years of age)

- Female (Below 60 years of age)

- Senior Male (Above 60 years and below 80 years of age)

- Senior Female (Above 60 years and below 80 years of age)

- Super Senior Male (Above 80 years of age)

- Super Senior Female (Above 80 years of age)

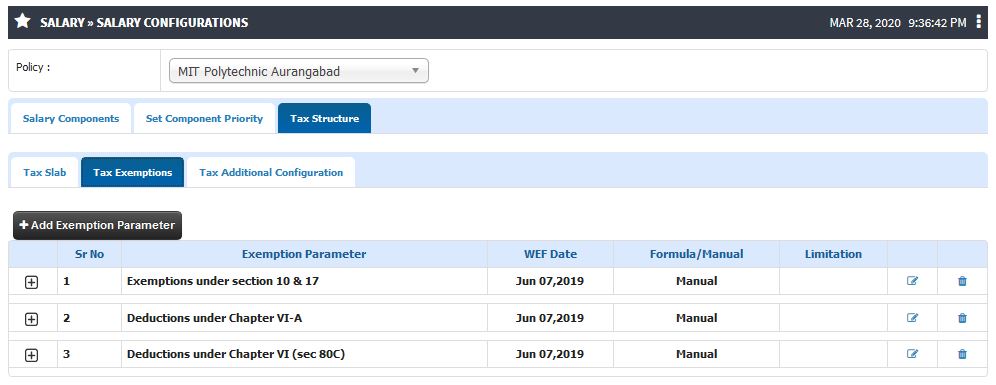

2. Tax Exemptions

a. Tax exemptions or monetary exemptions both heads and subheads can be added here.

b. Exemption limits, WEF (with effect)Date and type i.e. Formula/Manual and/or Addition/Deduction can also be set.

3. Tax Exemptions Additional

a. Education Cess in percent can be defined.

Reflection

- Based on the component type i.e. Basic / Addition /Deduction, the components are categorized on the UI.

- Basic Components are listed in Blue background.

- Addition components are listed in Green Background.

- Deduction components are listed in Red Background.

The color code is system defined and hence it becomes easier for the user to identify the component types.

Step by Step

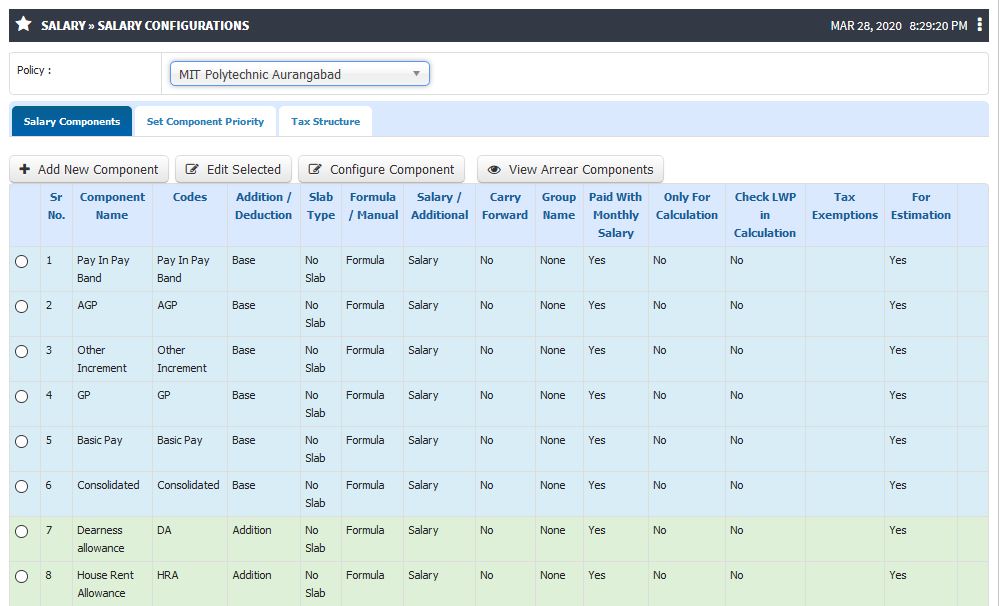

- Salary Configuration Menu

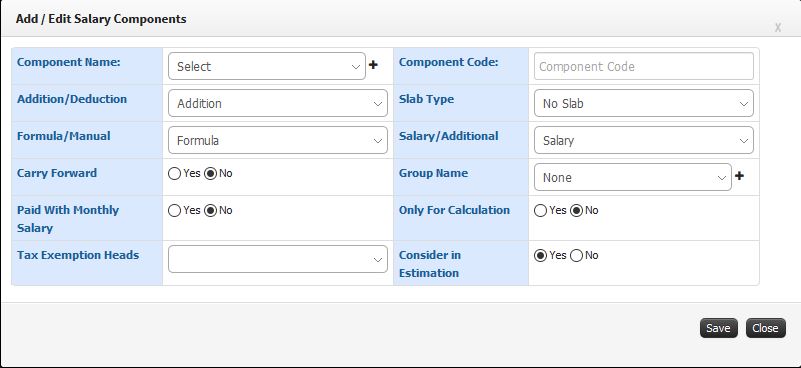

2. Add / Edit Component

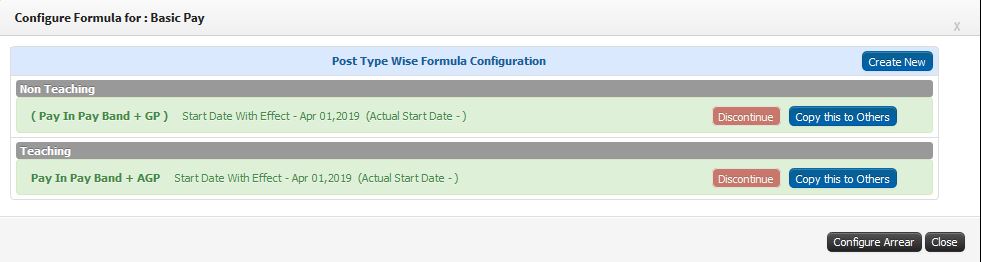

3. Configuring Salary Component

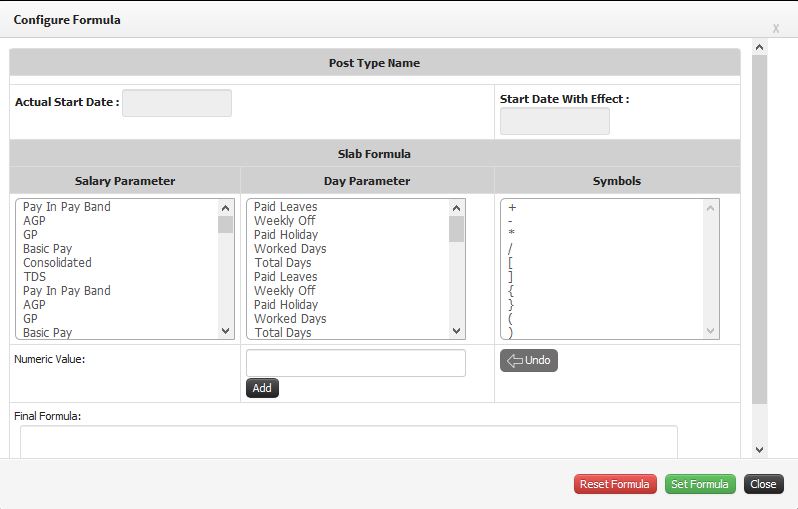

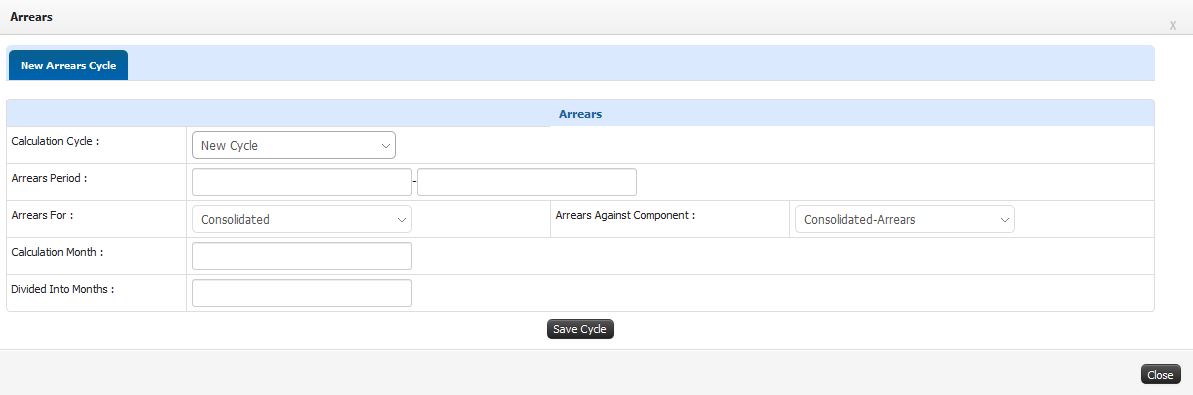

4. Creating New Formula Configuration 5. Configuring Salary Component 6. Setting Salary Component Priority7. Tax Slab

8. Tax Exemptions

9. Tax Addition