Difference between revisions of "ESIC"

(Tag: Visual edit) |

(→Step by Step) (Tag: Visual edit) |

||

| (7 intermediate revisions by the same user not shown) | |||

| Line 13: | Line 13: | ||

* ESIC as a deduction parameter should be configured in their salary calculation. | * ESIC as a deduction parameter should be configured in their salary calculation. | ||

* Salary component for ESIC should be configured with formula to check employee wages. | * Salary component for ESIC should be configured with formula to check employee wages. | ||

| + | |||

| + | == '''Functionality''' == | ||

| + | * ESIC Configuration is required to be updated in the system. Currently, the employee's contribution rate (w.e.f. 01.07.2019) is as follows: | ||

| + | # Wages upper Limit - ₹21000 | ||

| + | # Employers Share - 0.75% | ||

| + | # Employees Share - 3.25% | ||

| + | # Changeover Month, which will be “,” separated values, e.g. 4,8,12,etc. | ||

| + | * With some important internal calculations in the system, it checks the change over month with the current month and depending on the result, the system checks the upper limit of the wages and recalculates the ESIC employee (Eg:18000 < 21000) | ||

| + | * If this calculation is '''True,''' then ESIC component is mapped automatically for the employee and a flag (''EsiEligibilityFlag'') will be set true. | ||

| + | * ESI Employee Amount = (ESI Wages calculation result * Employees Percent)/100 | ||

| + | * ESI Employer Amount = (ESI Wages calculation result * Employers Percent)/100 | ||

| + | |||

| + | == '''Cases''' == | ||

| + | * If there is no value shown against for ESIC for employees whose wages / salary upper limit is less than ₹21000, then there can be two factors due to which the value is not shown: | ||

| + | # ESI component not configured. | ||

| + | # ESIC configuration not done. | ||

| + | * Employees whose wages / salary is more than ₹ 21000 are not eligible for ESIC deduction. | ||

| + | |||

| + | == '''Step by Step''' == | ||

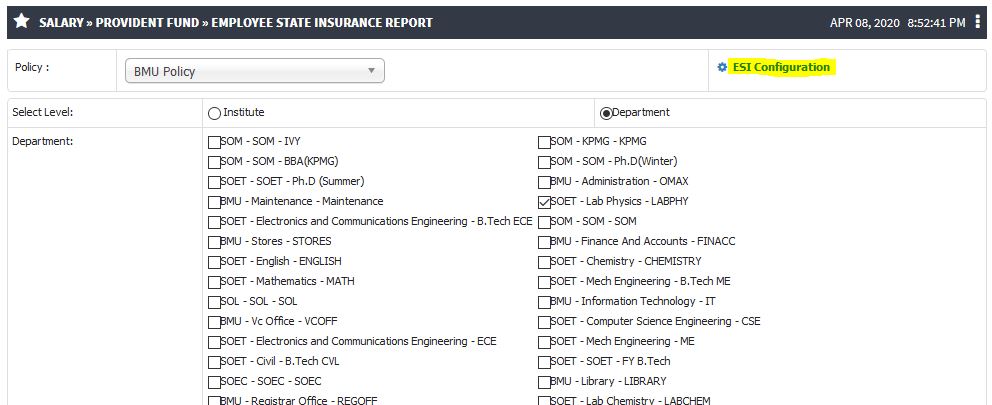

| + | # ESIC Monthly Report | ||

| + | [[File:ESIC Pg1.jpg|center|frameless|992x992px]] | ||

| + | |||

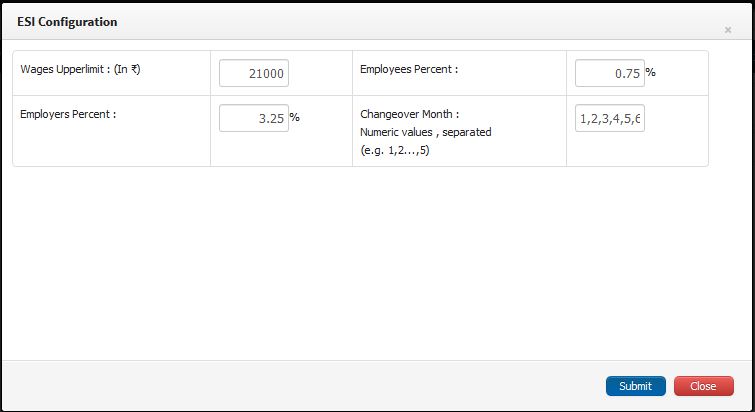

| + | 2. ESIC Configuration | ||

| + | [[File:ESIC Config.jpg|center|frameless|755x755px]] | ||

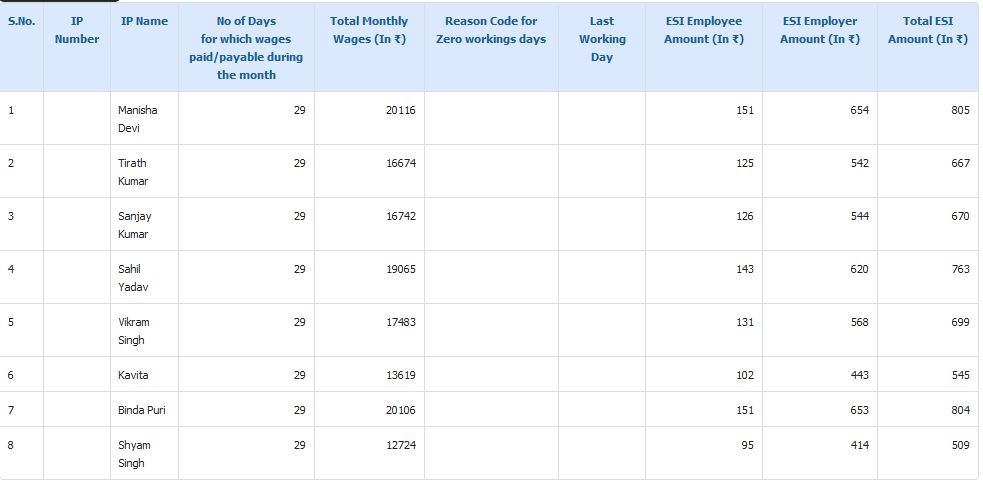

| + | 3. ESIC Report | ||

| + | |||

| + | [[File:ESIC Pg3.jpg|center|frameless|983x983px]] | ||

Latest revision as of 13:14, 8 April 2020

ESIC

E.S.I. Scheme being contributory in nature, all the employees in the factories or establishments to which the Act applies shall be insured in a manner provided by the Act. The contribution payable to the Corporation in respect of an employee shall comprise of employer's contribution and employee's contribution at a specified rate. The rates are revised from time to time. Currently, the employee's contribution rate (w.e.f. 01.07.2019) is 0.75% of the wages and that of employer's is 3.25% of the wages paid/payable in respect of the employees in every wage period. Employees in receipt of a daily average wage upto ₹137/- are exempted from payment of contribution. Employers will however contribute their own share in respect of these employees.

Role

- Finance

- Staff / Faculty

Path

Salary » Provident Fund » Employee State Insurance Report

Inputs Needed

- Upper Limit of the wages, employer as well as employees share in percentage should be correctly at the time of configuration.

- ESIC as a deduction parameter should be configured in their salary calculation.

- Salary component for ESIC should be configured with formula to check employee wages.

Functionality

- ESIC Configuration is required to be updated in the system. Currently, the employee's contribution rate (w.e.f. 01.07.2019) is as follows:

- Wages upper Limit - ₹21000

- Employers Share - 0.75%

- Employees Share - 3.25%

- Changeover Month, which will be “,” separated values, e.g. 4,8,12,etc.

- With some important internal calculations in the system, it checks the change over month with the current month and depending on the result, the system checks the upper limit of the wages and recalculates the ESIC employee (Eg:18000 < 21000)

- If this calculation is True, then ESIC component is mapped automatically for the employee and a flag (EsiEligibilityFlag) will be set true.

- ESI Employee Amount = (ESI Wages calculation result * Employees Percent)/100

- ESI Employer Amount = (ESI Wages calculation result * Employers Percent)/100

Cases

- If there is no value shown against for ESIC for employees whose wages / salary upper limit is less than ₹21000, then there can be two factors due to which the value is not shown:

- ESI component not configured.

- ESIC configuration not done.

- Employees whose wages / salary is more than ₹ 21000 are not eligible for ESIC deduction.

Step by Step

- ESIC Monthly Report

2. ESIC Configuration

3. ESIC Report