Voucher (Income/Expense) Configuration

Contents

Voucher (Income/Expense) Configuration

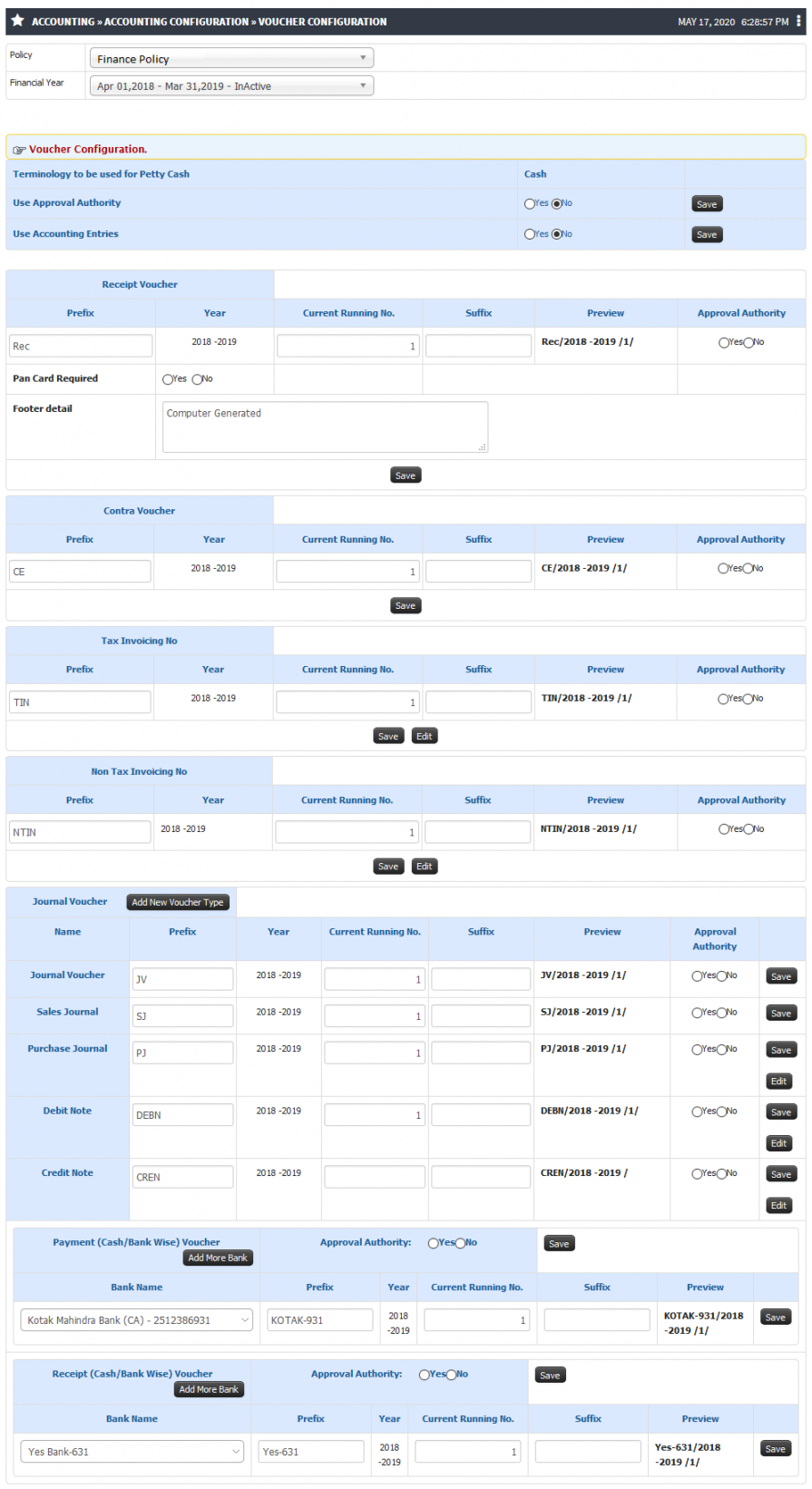

Voucher (Income Expense) Configuration allows user to Configure all types of voucher with prefix, accounting year, continuation no., suffix,etc.User will be able to configure this details as per the voucher type for each financial year,so each accounting entry will be recorded in Book of Accountancy with unique and auto generated number.

If user wants to get any accounting entry to be validated by Higher Finance authority,this UI allow to configure the Approval Authority as per the voucher type.Such accounting entries will be recorded in the Book Of Accountancy only after the approval of authority.

Roles

Finance Admin

Path

Accounting » Accounting Configuration » Voucher Configuration

Terminologies Used

- Petty Cash : Petty Cash is a small amount of Cash that is kept on the organization/ institute to pay for minor cash needs.Examples of these payments are office supplies, daily expenses and so forth.

- Receipt Voucher : Receipt voucher is used to record cash or bank receipt.Receipt vouchers are of two types:

- Cash receipt voucher, Cash receipt voucher denotes receipt of cash.

- Bank receipt voucher, Bank receipt voucher indicates receipt of cheque or demand draft.

- Payment Voucher: Payment voucher is prepared for all payments

- Cash Payment Voucher:- These vouchers are used only in case of cash payment.

- Bank Payment Voucher: These vouchers are used when the payment is made through bankers.

- Journal Voucher : Journal Voucher (JV), Perform accounting tasks that cannot be done by any of the other financial transactions documents and correct errors that unbalance the General Ledger.The accounting entries which you cannot record using other voucher types shall be recorded using JVs. JVs are the entries which are neither purchase, sales , receipt, payment and contra

- Contra Entry : Contra Entry (CE), This is used mostly for transactions from bank to cash or vice versa. Cash withdrawn and bank deposit transactions. Following transaction can be done through Contra 1. Cash account to Cash account 2. Cash account to Bank account 3. Bank account to Cash account 4. Bank account to Bank account

- Sales : Sale Voucher same as sales invoice, A sales voucher is a record of a sales transaction. A sales voucher has several purposes. Because it originates at the point of sale, it provides reliable real-time information to accounting, inventory and management.The voucher records all entries related to sales including cash and credit.

- Credit note : A credit note is a document sent by a seller to its buyer or, in other words, a vendor to the customer, notifying that a credit has been provided to their account against the goods returned by the buyer.The credit note is an invoice monetary document circulate by a retailer to a customer. Credit notes function as a reference record for the Sales return journal.

- Debit note : A debit note in accounting means a document issued by the buyer of goods or services to the seller.A debit note can be issued from a buyer to their seller to indicate or request a return of funds due to incorrect or damaged goods received, purchase cancellation, or other specified circumstances.

Pre-Requisite

- Finance Policy must be created

- Financial Year must be created

- Finance Admin Role to User

- Bank and Cash Ledger must be created for Receipt and Payment voucher Configuration

Inputs Needed

- Terminology to be used for Petty Cash Configuration

- Use Approval Authority Configuration

- Receipt Voucher Configuration(e.g Cash/Bank)

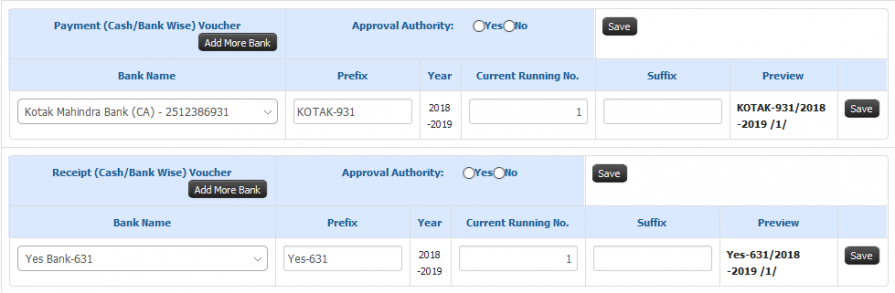

- Payment Voucher Configuration (e.g Cash/Bank)

- Other Voucher Type Configuration(e.g JV,CE,Tax Invoice,Non Tax Invoice)

Functionality

- Able to define terminology to be used for Petty Cash

- Able to configure/change Use approval authority configuration for an individual or all Voucher Type

- Able to Use Accounting Entries UI which allows to make all accounting transactions from single UI

- Able to configure/edit numbering with Prefix and Suffix for Tax and Non Tax Invoicing

- Able to configure/edit numbering with Prefix and Suffix for all Voucher Type

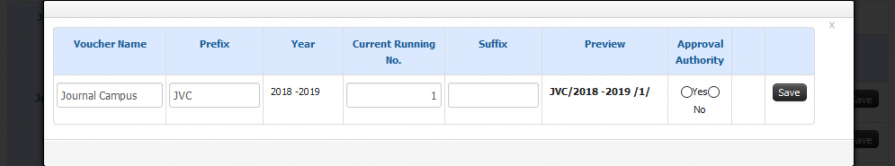

- Able to add new Voucher Type as required for accounting purpose

Step by Step

1.Voucher Configuration2. Add New Voucher Type3. Payment & Receipt Voucher Configuration